Cash strapped, but so what?

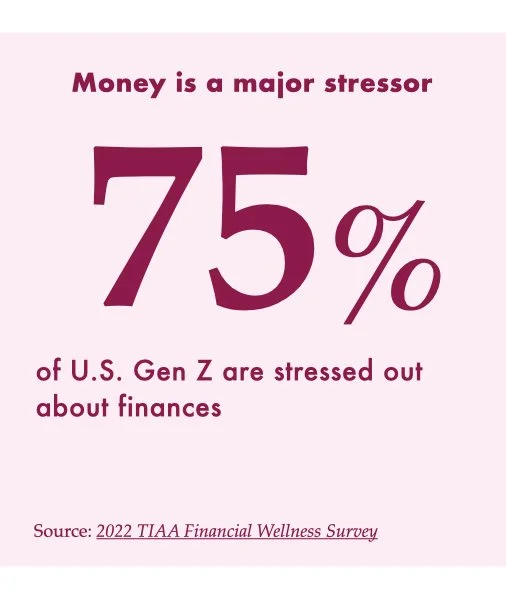

Gen Z doesn’t have much money. But, who did at a young age? (This is not a question for the privileged). Headlines resound with doomsday prophesies for Gen Z, who is now battling student debt and rising inflation, and has been completely priced out of the housing market. The economic and financial turmoil Gen Z has witnessed, with their parents or as young workers themselves, has made uncertainty the norm by which they navigate their financial futures. It’s complicated by a distrust in institutions and employers, which Gen Z is becoming increasingly vocal about calling out. On paper, they are economically burdened, considering their hefty student loan debts and that paying a $400 emergency expense would hurt Gen Z the most. The weight of their collective finances is perhaps so large that Gen Z have begun to accept it as the norm, and they’re unfazed by it. In the U.S., the long-term realities of financial stress are starting to manifest themselves in previously unseen behaviors such as choosing to simply give up, or, “lie flat,” as the youth in China call it.

Gen Z has financial chops, and they are ready for risk

Gen Z is into risky business. While they may be pressed and stressed about money, Gen Z also has an appetite for novel financial pursuits outside of institutional norms. They are flocking to expensive cities, such as San Francisco and New York, far outnumbering the rental applications of their older counterparts. Even in a year where rents in major U.S. cities have skyrocketed up to 40%, it’s Gen Z that is moving to urban centers, according to recent rental application data. And Gen Z’s trust in technology has forged a comfort level with fintech, digital currencies, and crowdsourcing platforms, where they can directly support causes that reflect their values with micro-donations, without a middleman charity or institution involved. Combined with a sense of distrust in institutions and having witnessed the financial strife and worries of both their Gen X parents and Millennial peers, Gen Z is driven to approach finances in a fresh way. That can manifest itself in exploring money-making in novel ways, emphasizing short-term gains over longer-term pains. That can mean intentionally job-hopping, skipping hefty student loans, or exploring digital alternatives, from investing in crypto for retirement to NFTs — even if they don’t fully trust them. A healthy, learned sense of skepticism underlies their financial motives.

Gen Z is using platforms like TikTok to elevate female finance voices, and educate their peers on all things money. Financial plans, even for retirement, can now be born from memes or “expert” influencers on Instagram or Tik Tok. Open platforms from TikTok to sub-Reddits are helping Gen Z rethink means of gaining wealth and saving for tomorrow. Sometimes the future may be too abstract for them: “Who cares about saving for retirement if the planet will implode by the time I’m 65?”